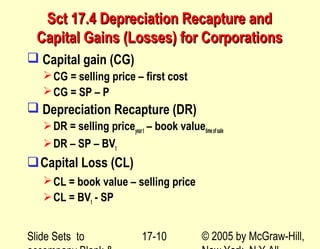

Depreciation recapture formula

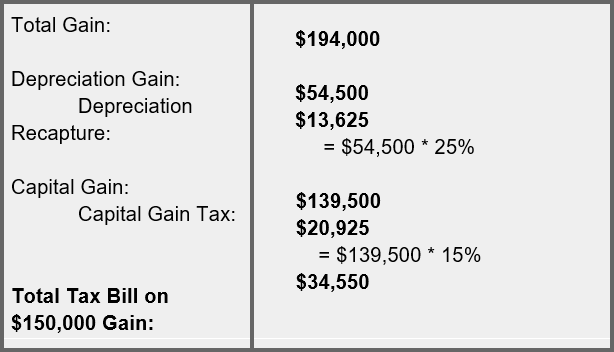

When you sell the property unless you are doing a tax-free exchange for another investment property you will owe recapture on the depreciation you have taken at a rate of 25 percent. The content is suitable for the Edexcel OCR and AQA exam boards.

Contributed Property In The Hands Of A Partnership

In the example above if Jane had taken 10000 in.

. SYD depreciation depreciable base x remaining useful lifesum of the years digits depreciable base cost salvage value Example. Wouldnt it be great if you could speed up your depreciation deductions. It gives larger depreciation figures at the beginning.

A 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred and paid at a later time. Amortization of costs that begins during the 2021 tax year. Record the annual depreciation.

Unfortunately depreciation for residential rental property is particularly slow. Cash capital assets and 1231 assets to the extent in excess of depreciation recapture and generally any assets the sale of which produce capital gains or losses. What the IRS gives the IRS will eventually take back in the form of depreciation recapture.

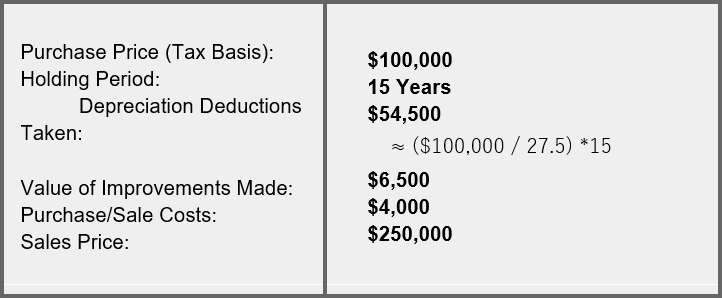

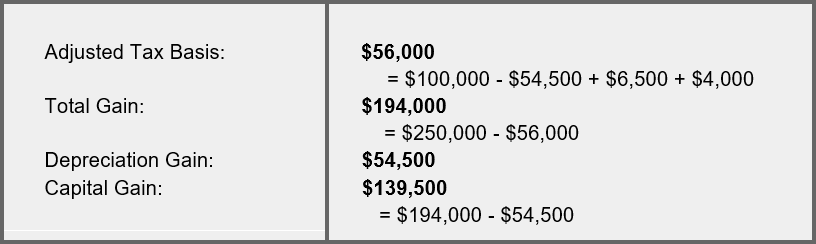

There is a formula for computing the tax basis of a personal residence converted to rental property. As you can see from the above example its quite complicated but you were able to figure out the depreciation recapture amount. Form FTB 3540 Credit Carryover and Recapture Summary.

Equation of a circle. Free online GCSE video tutorials notes exam style questions worksheets answers for all topics in Foundation and Higher GCSE. We welcome your comments about this publication and your suggestions for future editions.

Is if you converted your home into a rental when the market value of the property was below your adjusted basis per the formula. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. You had net earnings from self-employment of at least 400.

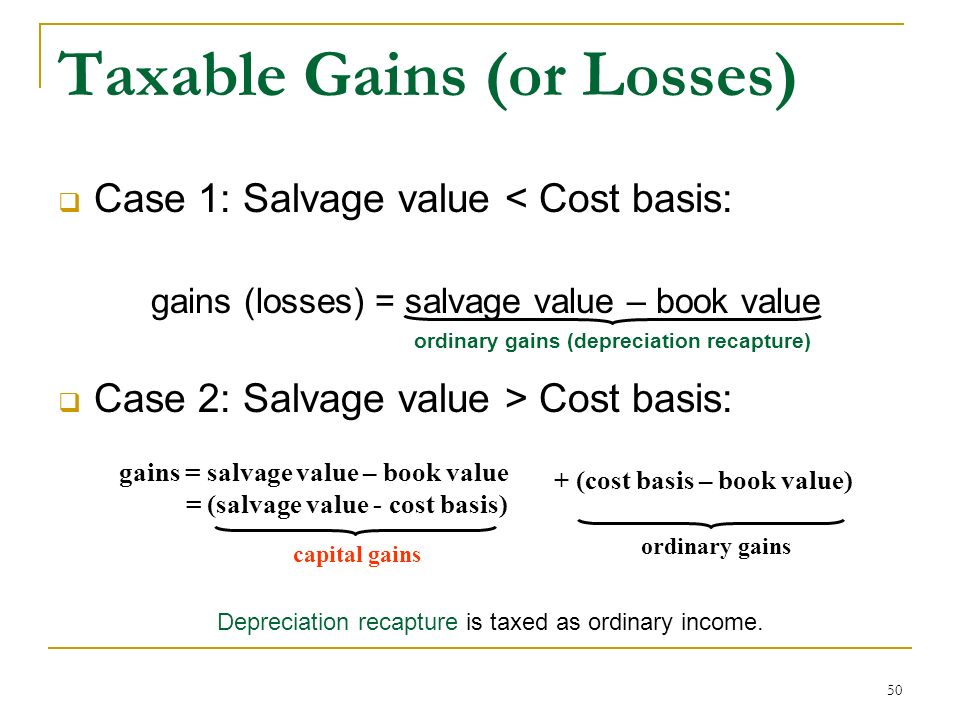

The increase in value over the original purchase price. Depreciation recapture is essentially paying tax on a portion. The tax deferred price is based on the following formula 43 x CEC 1971 Value where the CEC is the cumulative eligible.

We will also discuss capital loss and how it works to offset the Capital Gains Tax. There are a few things to note here. Cost of property Land value Basis.

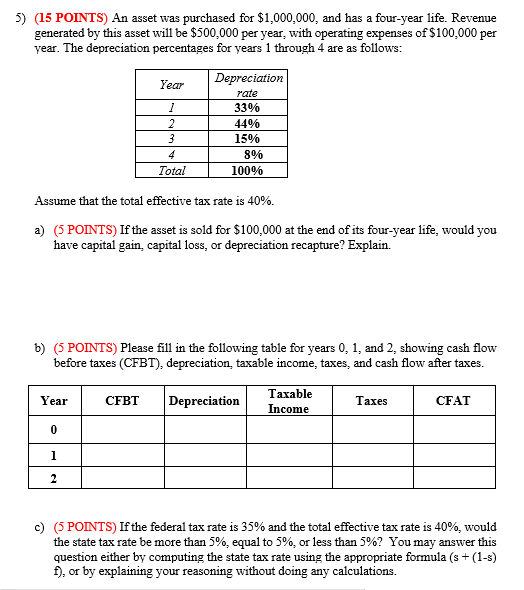

The total amount of depreciation you claimed during the rental period is not eligible for the exclusion. MACRS declining balance changes to straight-line method when that method provides an equal or greater deduction. This guide explains all tax implications of selling a commercial property.

Di C Ri. If an asset has original cost of 1000 a useful life of 5 years and a salvage value of 100 compute its depreciation schedule. Macrs depreciation schedule Recapture How Residential Rental Property Depreciation Works What Properties Are Depreciable Rental Property Depreciation Method Rental Property Depreciation.

1231 property is real or depreciable business property held for more than one year. The formula to calculate depreciation under SYD method is. Depreciation on any vehicle or other listed property regardless of when it was placed in service.

Write the form number and the recaptured amount on the dotted line to the left of line 37. In addition to that you will learn about the ways to. Calculating Cost Basis and Profit.

So if you took 100000 in depreciation you might owe 25000 in taxes on top of any profit. Any depreciation on a corporate income tax return other than Form 1120-S. If the estate or trust completed the credit recapture portion of any of the following forms include the recapture amount on line 37.

In other words youll have to wait 275 years to deduct the full cost of your rental buildings. Equations of parallel lines. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Change subject of a formula. Use the double-declining balance depreciation rate which is double that of the straight-line depreciation rate. This is known as the straight-line method for calculating depreciation cost and its the only acceptable formula for calculating the depreciation cost of a property according to the IRS.

The rest of your sale value will be taxed at a lower tax rate that applies to 1231 properties. While this is often called a capital gain technically only capital property can generate a capital gain. Form FTB 3531 California Competes Credit.

The formula for depreciating commercial real estate looks like this. You or your spouse if filing jointly received health savings account Archer MSA or Medicare Advantage MSA distributions. Difference of two squares.

MACRS Formula Using GDS Cost basis of the asset x Depreciation rate. Depreciation recapture and 1031 exchanges. Under depreciation recapture rules the amount of money you depreciated will be taxed at a higher ordinary income tax rate.

Tax basis for depreciation. Then the depreciation figures decrease as time goes by. Decreases to basis include depreciation and casualty losses.

NW IR-6526 Washington DC 20224. The ordinary income assets consist of unrealized receivables and inventory items that have appreciated substantially in value1 An explanation of these assets follows. The depreciation period for residential rentals is 275 years.

You will learn about the types of taxes you have to pay. The depreciation recapture amount will be 61600. A deduction for any vehicle reported on a form other than Schedule C Form 1040 Profit or Loss From Business.

To calculate use this formula. When you buy an asset like a. Depreciation for 2009 using Table A-1 is 100 million 20 20 millionDepreciation in 2010 100 million - 20 million 15 200 32 millionDepreciation in 2010 using Table 100 million 32 32 million.

Starting net book value x Depreciation rate. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. One of the benefits of having a rental is the ability to claim depreciation on the property which allows you to offset rental income that would otherwise be taxed as ordinary income.

Section 1245 Depreciation Recapture Rules. Instead you must recapture all your depreciation deductions--that is report them on IRS Schedule D and pay a flat 25 tax on these deductions. See the instructions for Forms 1040 and 1040-SR line 16 and Schedule 2 Form 1040 lines 10 through 18.

The formula is the cost of the property divided by its useful life. Equation of a tangent to a circle. You may have to report the recognized gain as ordinary income from depreciation recapture.

When commercial real estate is sold the difference between the basis and the sales price must. Federal Capital Gains Tax CGT long-term and short-term state taxes and depreciation recapture. You can avoid depreciation recapture altogether through a 1031 exchange.

This can have a significant tax impact. In the sale or exchange of a portion of a MACRS asset discussed later the adjusted basis of the disposed portion of the asset is used to figure gain or loss. The recapture of depreciation previously taken.

So now you know how much you will pay when you sell a property and you can decide if. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties.

Learn About Depreciation Recapture Spartan Invest

Learn About Depreciation Recapture Spartan Invest

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Chapter 2 The Corporate Income Tax Ppt Download

Solved A Property Purchased For 100 000 With An Noi Of 7 000 Per 10 Years Will Be Sold For 140 000 There Is No Cost Of Sale Depreciation Taken Course Hero

5 15 Points An Asset Was Purchased For 1 000 000 Chegg Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Chapter 17 After Tax Economic Analysis

Learn About Depreciation Recapture Spartan Invest

Depreciation And Income Taxes Asset Depreciation Book Depreciation

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Like Kind Exchanges Of Real Property Journal Of Accountancy

Depreciation And Income Taxes Prezentaciya Onlajn

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Depreciation Starting With The Basics Ilsoyadvisor

How To Use Rental Property Depreciation To Your Advantage